I Sold Some Bitcoins

I held the flimsy scrap of printout up to the Bitcoin ATM’s scanner, tapped its screen, and ten crisp hundred-dollar bills shot into the delivery tray at the bottom. Maybe Bitcoin is real?

What happened was, back in April when Bitcoin was last spiking, I bought a few, not using any of the exchanges (setup seems pretty heavyweight) but from another enthusiast, with cash. The price headed for the basement as soon as I loaded up, so I was feeling kind of stupid. But now it’s spiking again; nobody knows why, but I hear hints of big pools of money hovering, wanting into this asset class.

Anyhow, this week it’s over double what I paid, and while I think Bitcoin is more interesting as a payment mechanism than an investment vehicle, de facto I had an investment way in the black. In that situation, you have to think about taking some off the table; and there’s been a flurry of news about the new Bitcoin ATM in Vancouver.

So Lauren and I headed down to the undistinguished coffee shop on an undistinguished downtown corner and there it was.

It’s the size of a refrigerator. The screen has three choices: BUY BITCOIN, SELL BITCOIN, and REDEEM TICKET. On the right are a barcode scanner, a palm scanner, and an ID document reader; I think you need to use these if you’re buying bitcoin and don’t already have a wallet. At the lower bottom are slots for a credit card, and for taking money in and pushing it out.

I was in taking-it-out mode. So I tapped SELL BITCOIN and here’s how it worked:

It asked how much how much; the usual kind of screen with ±$20 and ±$100 buttons like you see on transit-fare machines. I said $1000.

It said that would be 2.40701 Bitcoins and printed out a little strip of paper of paper with two QR codes. One described the destination and amount, the other was called a “Transaction Redeem Code”.

I use the Blockchain.info service for my Bitcoins, and it comes with an OK Android client. The camera on my Nexus 7 wouldn’t read the QR code on the slip, but it had no trouble with the one on the ATM screen. Blockchain said “OK to send the Bitcoins?” and I agreed.

At this point, the user experience was a little puzzling. Eventually I figured out that it wanted me to say “OK, I’m done”, then use the REDEEM TICKET top-level choice.

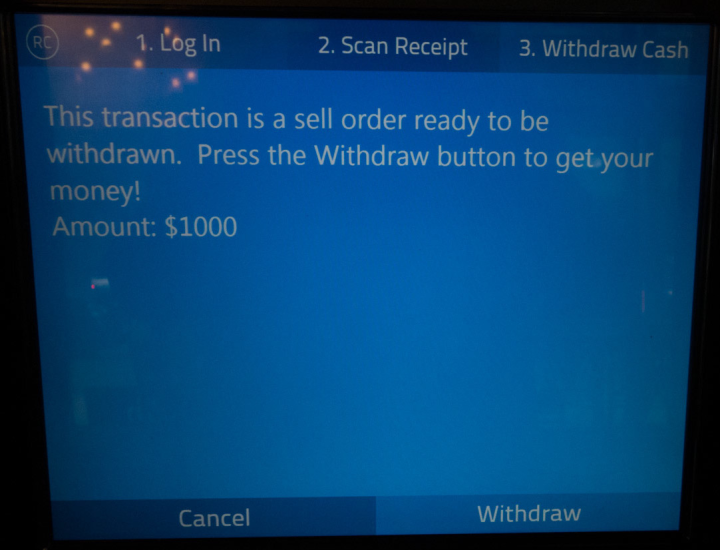

So I did that, it asked me to hold up the second QR code in front of its scanner, and I instantly got this cheery screen.

Tapping “Withdraw” got me a popup saying “0 of 1 required confirmations received, the Bitcoin network is still processing this transaction.” OK, I guess. I tried a few more times over the next ten minutes, then got bored and went shopping.

An hour later we returned to the coffee shop, scanned the redemption slip one last time, and Bang!, there was the cash.

What is Bitcoin For? · I think Bitcoin is interesting because it potentially offers very low transaction costs and doesn’t much notice national borders.

As an investment vehicle, well... I’m not smart enough to understand it. I guess what I’ll do is, if it stays up here, take enough out to get my money back and let the rest ride. I dunno, if it then plunges again I might buy some more on the assumption that the gyration will continue.

An important quality of of a useful currency is stability, and Bitcoin clearly doesn’t have any.

I do feel a bit like a doofus though, for not having actually studied up on the crypto and done some mining back in the old days. There’s one Bitcoin mailing list I’m on, full of extremely technically competent people; someone there casually mentioned that, as an old-timer, he’d been on the ride long enough, so he cashed in half his Bitcoins this month and paid off his mortgage. And, he noted, had retained a first-rate tax attorney.

Comment feed for ongoing:

From: Michael Norrish (Nov 15 2013, at 19:42)

It seems pretty clear to me that Bitcoin is a complete waste of money, at least in the limit. People like yourself may well make money as the bubbles inflate and deflate, but as there is no intrinsic value to a Bitcoin, you might as well be buying and selling shares in the South Seas venture.

People may claim that fiat currencies such as the USD have no intrinsic value either. This would be true but for just one thing: a large population of people have to hand them over to the US government when tax time comes around.

Bitcoin's clear advantages as a medium of exchange are all very well, but I can't see the sense of using a medium with no intrinsic value.

[link]

From: John Cowan (Nov 16 2013, at 14:04)

Michael Norrish: Eurodollars (that is, those created outside the U.S. by banks making loans denominated in dollars) are probably 90% or more of all dollars, so your explanation doesn't explain. The fact is that currencies have value precisely to the extent to which people accept them. There is no such thing as "intrinsic value", or gold would be interesting only to dentists, jewelers, and semiconductor manufacturers.

[link]

From: Michael Norrish (Nov 17 2013, at 22:19)

John Cowan: banks can't create dollars; only the Federal Reserve can. And inasmuch as they can sell things (like bonds denominated in dollars) that stand for dollars, those things will have value because dollars have value.

Gold is a nice case study too. It's clearly overvalued because of its historical use as a currency. Its intrinsic worth is for just those uses you describe. People buying gold are essentially gambling just as people buying bitcoins are because the speculative worth so grossly exceeds the intrinsic worth.

Of course, you're right that things are worth what people will pay for them. Nonetheless, if you are only buying something because you are confident that someone will buy it off you again, that's a signal that the thing you bought has no intrinsic value.

[link]

From: Ian Rae (Nov 18 2013, at 07:53)

Bitcoin is not money. It is neither a medium of account or a medium of exchange in any meaningful way.

See http://worthwhile.typepad.com/worthwhile_canadian_initi/2012/10/medium-of-account-vs-medium-of-exchange.html

During the Mexican inflation crisis of the early 90s, people bought and sold things using appliances as money. A brand new toaster in its box had a more stable value than the currency. Bitcoin is not even at that level yet as money.

[link]

From: Michael Kozakewich (Nov 23 2013, at 11:31)

BitCoin is a funny one. The thing is, it's not intrinsically worthless, because people are pumping in their own thousands of dollars and hundreds of hours in the form of mining. I'm not sure how things will stabilize in the end, but right now we're at the very beginning of the growth curve. It could very well exceed $10,000 per coin within the next two years. By that time, a couple hundred dollars in fluctuation would be no worse than is CAD to USD conversion these days, and it would mature into a sort of better PayPal.

Essentially, we can't possibly judge it for another year or two. It's just not ready. Think about Facebook back in 2007.

[link]